A 2021 Homeownership Report indicates that nearly 18% of the 72+ million millennials believe they will rent forever. There are many reasons why we believe this is a bad idea, but let’s start with just one — inflation. Yes, right now we are experiencing unusually high inflation, but inflation exists almost always. Nationally, over the extended period 2011-21, it has averaged +2% (USFacts.org). This may seem relatively small on an annual basis, but when compounded over time - it is significant at any price point.

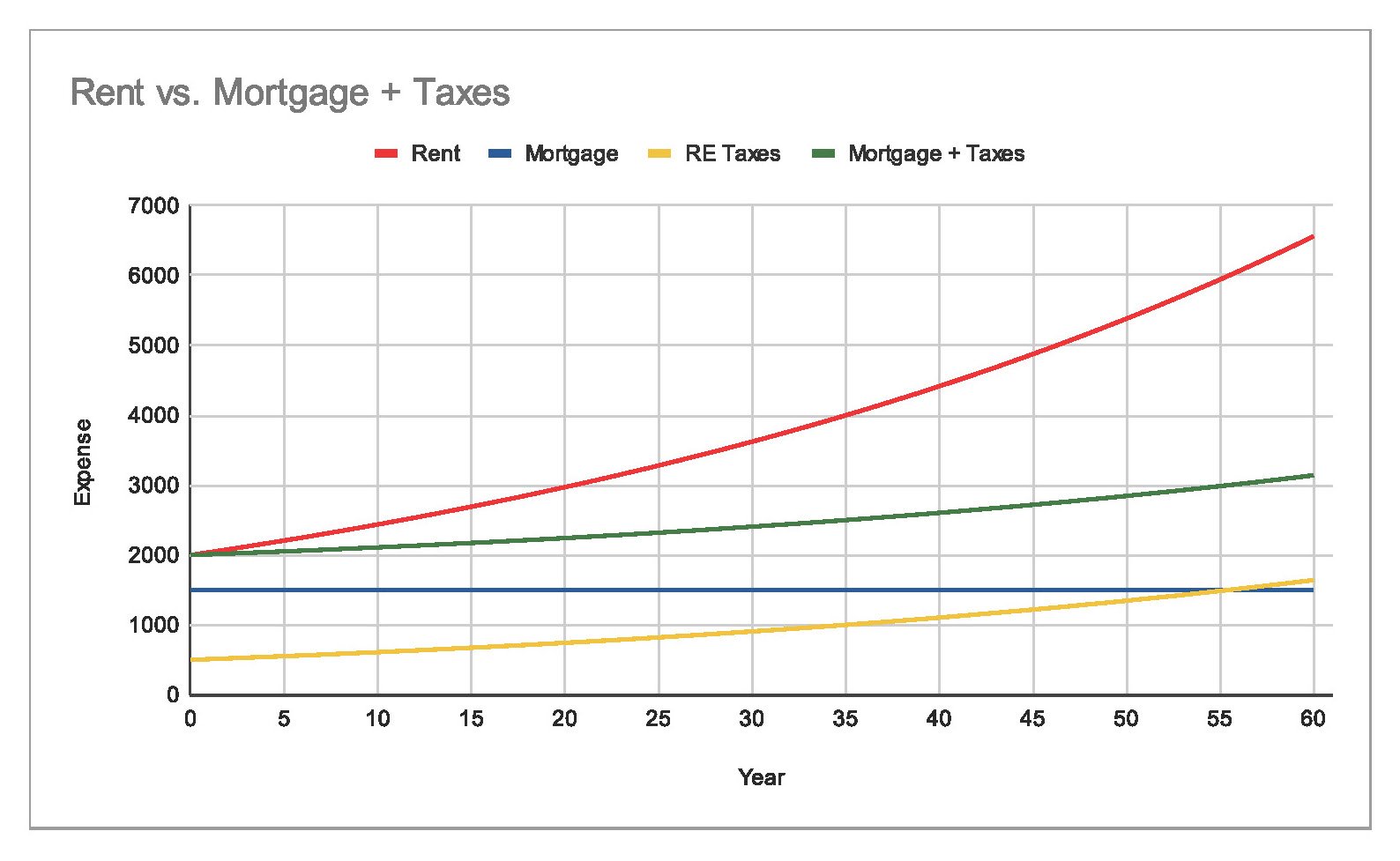

In many areas rental rates have spiraled upwards, outpacing inflation. But let's be conservative in this analysis, assuming both rent and real estate taxes rise at a consistent 2% rate. In year 0, rent is $2,000, while a mortgage is $1,500 and property taxes are $500 —seemingly a toss-up. Over time however, the differential between a fixed rate mortgage + taxes and a rising monthly rent payment becomes staggering — lower by: 7.6% in 5 years, 15.6% in 10, 32.5% in 20 and 50.6% in 30.

Additionally, in 30 years, your conventional fixed mortgage would be paid off, making the real comparison the annual property tax payment of $10,872 vs a rental cost of $43,476!

Clearly, compounding inflation is an important downside to renting. Here are a few more:

Renting offers no sense of stability – Over the past 20 years, only 5-10% of homeowners moved in any given year. Contrast this with 16-33% of renters moving in any given year. Here we go again is the mantra. Whether it’s to get a better, cheaper or more convenient apartment, moving is a hassle and expensive! Carting your belongings, setting up utilities, paying and getting back security deposits – all take time and money, not to mention an emotional strain on yourself and your family.

Renting offers no opportunity to make improvements/investments – It is not your home. You can’t renovate the kitchen, add a bathroom or build above the garage. Need more suitable space? Time to move.

Renting won’t add to your net worth – Real Estate has proven to appreciate in value over time, particularly when you invest in it (per above). Homeowners can benefit from rising property values and growing equity with each mortgage payment. A rent payment simply lowers your bank account balance. When emergencies arise, homeowners have the ability to use home equity as collateral for a second mortgage, if necessary.

Renting won’t lower your income taxes – Mortgage interest and property taxes paid can be used as deductions against your income taxes. Make energy saving improvements to your home and you might even save more!

Rental properties don’t offer as much privacy – Repairmen do not work on your schedule and your landlord typically has the right to enter your premises, particularly when showing to a prospective new tenant. Approximately 60% of rental properties are 2 or more units (duplexes, apartments). Sharing flimsy walls with other tenants can be awkward at best and annoying at worst.

Rent payments never end, or stay the same – Sure, you can retire and move to a cheaper location, but you will still be paying rent. And your landlord dictates how much the rent be each time you sign a new lease (hint - more than the prior year!). Homeowners can live a more comfortable retirement in their now mortgage-free home or “right-size” into a new home using the equity they built over the years of ownership.

Subletting or breaking a lease can be costly or impossible – Circumstances change. Whether it be due to a job transfer or personal matter, getting out of a lease or subletting can be challenging. If you own your home, you have the flexibility to rent it to whomever, whenever you choose for two months or two years.

There are also a few intangible benefits to home ownership:

Stronger social ties to the community – Committing to a house, a neighborhood, a town makes it easier to get involved and become attached to the community. Children will stay in the same school, retain the same friends and generally feel more secure.

Many experts argue that homeowners are more financially responsible – The discipline needed to budget and save for that first down payment on a home tends to have lasting impact. Some use strategies to pay more each month towards their principal borrowed, saving loads of interest over the long run. Many end up paying off their mortgage in less than the initial (often 30 year) term.

You can have Fido and grass for him to play on – Owning pets while living in an apartment can be costly and a challenge. Outdoor living spaces are huge positives!

Lastly, your home is an asset that can be passed on.

Have questions? We are here to help guide you step-by-step through the process. Minimal stress & maximum value is our mantra!